Conclusion of Capital Structure

Capital structure is a very important aspect of a balance sheet as it reflects the financial stability of a company. In document The determinant of capital structure in SMEs.

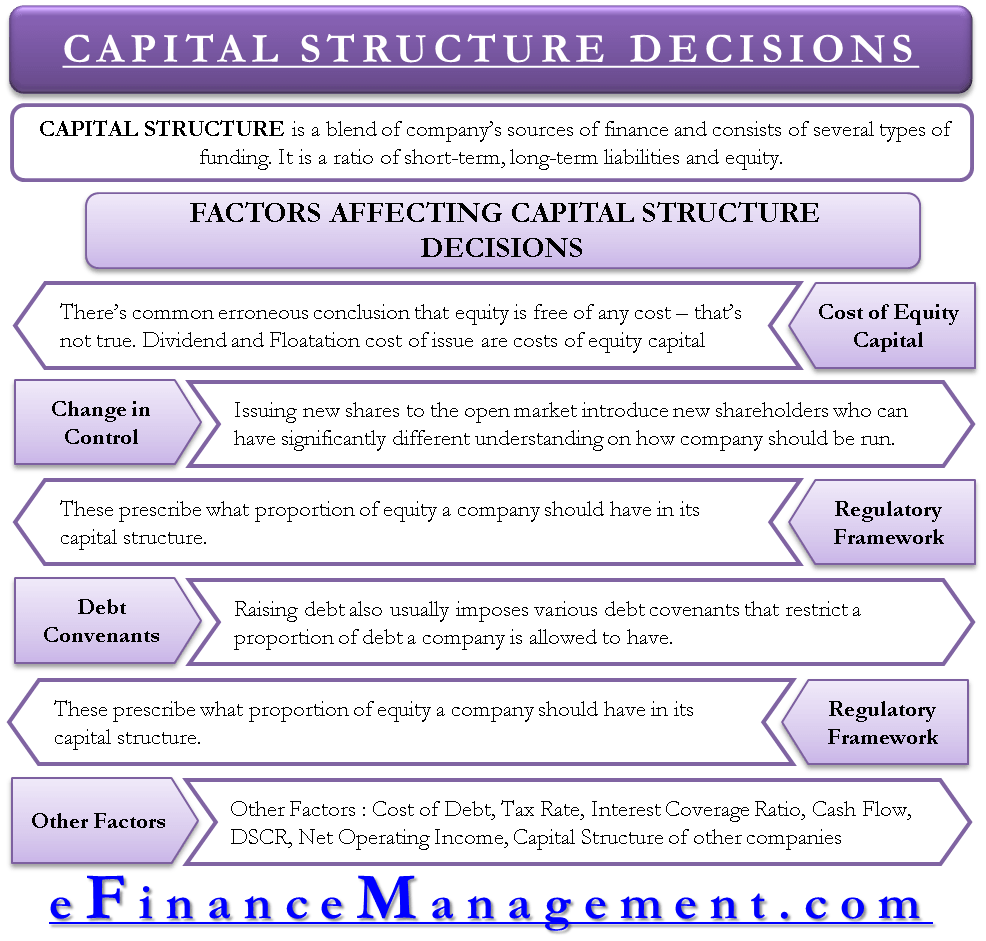

Factors Affecting Capital Structure Decisions Efinancemanagement

Up to 3 cash back CONCLUSION.

. It should offer the least cost of financing with maximum returns. In 1958 through combining tax and debt factors in a simple model to price the value of a company. In particular use of equity and debt capital needs.

In this study we. It can also show company. Capital structure is the composition of a companys sources of funds a mix of owners capital equity and loan debt from outsiders.

20000 of cash available in the company 40000 of the company bonds should be used and. The basic purpose of this research is to study and to define the factors which have effect on insurance companies profitability. Capital structure relates to how much moneyor capitalis supporting a business financing its assets and funding its operations.

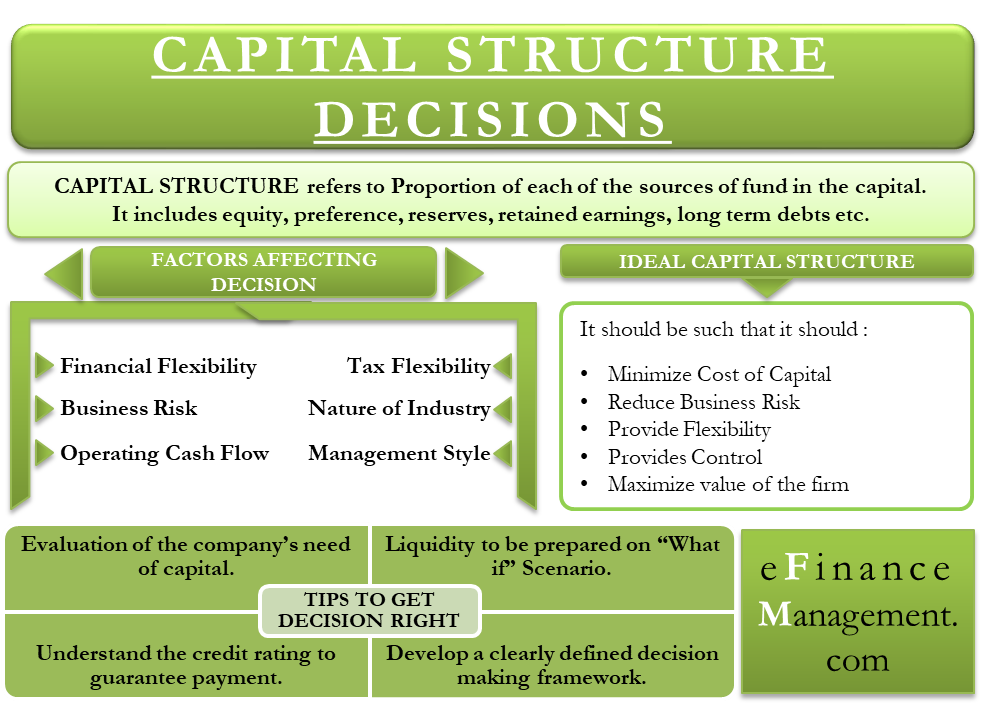

Solvency -the structure should. In financial management capital structure theory refers to a systematic approach to financing business activities through a combination of equities and. Simply speaking capital structure mainly contains two elements debt and equity.

Many studies report the low performance of state-owned firms. Up to 5 cash back Capital Structure. Conclusion Capital structure continues to be the backbone and financial foundation for any organization.

It is used to finance its overall operations and. The accountants suggested the following capital structure to fund the project. Profitability -it should ensure most profits are earned.

Simply speaking capital structure mainly contains two elements debt and equity. In document Capital structure corporate cash holding and dividend policy in African countries Page 117-126 This study examined the trends and determinants of. Since the ability to access capital directly affects the value of a business owner-managers need to understand the ramifications of this.

Cost of capital is the minimum rate of return that a business must earn before generating value. Features of A Good Capital Structure. The government-linked firms are known as inefficient firms and they could perform better if they were under private ownership.

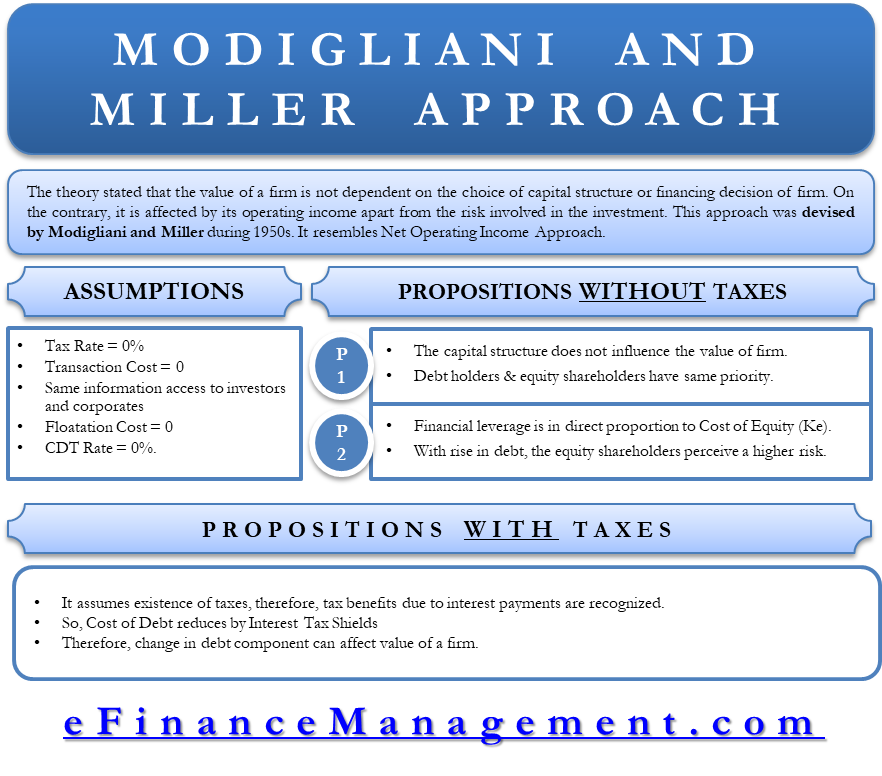

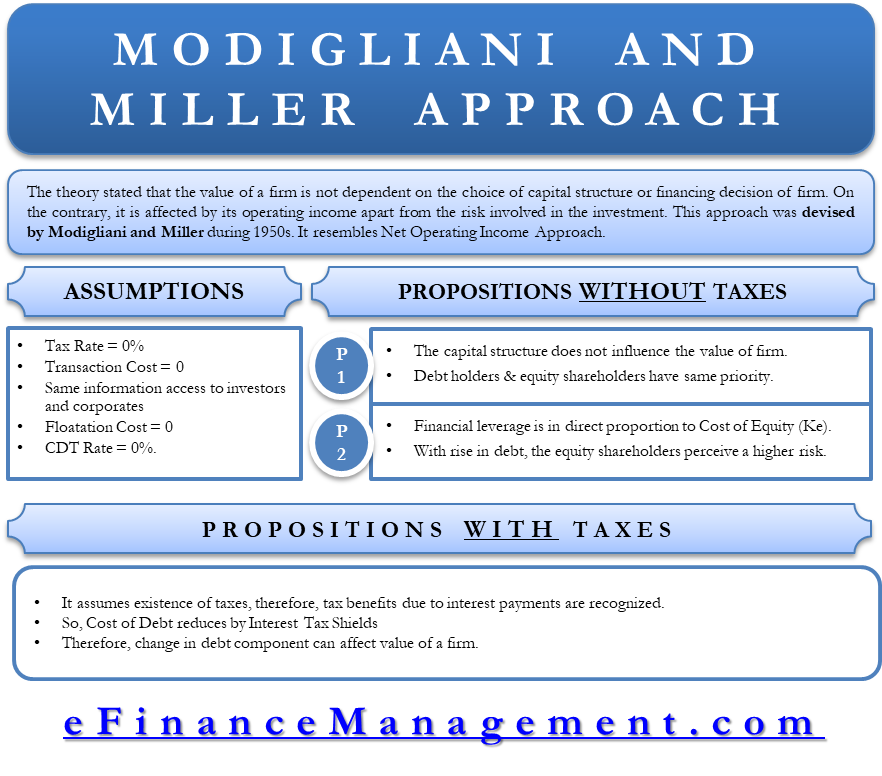

Debt comes in the form of bond. Before a business can turn a profit it must at least generate sufficient. Certainly the Modigliani and Millers Capital Structure Theory is not the.

In designing the capital structure for any firm the first major. Page 103-107 Chapter Two reviews the developments of the theoretical and empirical. Target Capital Structure Target capital structure is a function of expected profitability riskiness of operations vulnerabilities to outside constituencies.

The capital structure is how a firm finances its overall operations and growth by using different sources of funds. In designing the capital structure for any firm the first major policy decision facing the firm is that of determining the appropriate level of debt. Up to 3 cash back CONCLUSION.

Evidence from UK and China. For most of the.

Pin By Jean Mangan On Legal Writing Law School Inspiration Law School Prep Law School Life

Capital Structure Theory Modigliani And Miller Mm Approach Efm

Capital Structure Decisions Importance Factors Tips And More

Pin By Lizajd21 On Paralegal In 2022 Law School Inspiration Law School Prep Law School Life

0 Response to "Conclusion of Capital Structure"

Post a Comment